CASE STUDIES

CASE STUDIES

- Sold & closed 2 developments during 2020, for 7.85mm, inside Rockstar Capital Group

- Sold multiple other developments through Buller River & Estero Development bfr arms

- Brandon Rooks was a key component of pre-selling of 393 units for 55.45mm in new construction single family & multi family turnkey rentals during 2015 & 2016 in Kansas City, Oklahoma City, Columbia, Sc, Salisbury, Nc, Rogers, Ar. with an average of 15% annual cash on cash roi & 7.5% cap rate or higher.

- These projects were all at a projected 8% cap rate or higher & with a value of just over 31mm at the time of acquisition or building

- Brandon Rooks was integral in the sales of 708 renovation or existing turnkey rentals for 73.16mm from 2011 thru 2016 through a network of agents & contractors in various cities across the country. Boise, Birmingham, Memphis, Cape Coral, Indianapolis, Oklahoma City, Kansas City, Charlotte, Atlanta, Cincinnati, and many more with an average of 18% annual cash on cash roi & 8.0% cap rate or higher.

- Rockstar Investments also assisted in raising 10mm to acquire &/or build and structure 5 syndications which accounted for 359 units in a mix of apartment, townhome & commercial strip spaces during 2015 – 2016.

- Brandon Rooks was integral in the sales of 708 renovation or existing turnkey rentals for 73.16mm from 2011 thru 2016 through a network of agents & contractors in various cities across the country. Boise, Birmingham, Memphis, Cape Coral, Indianapolis, Oklahoma City, Kansas City, Charlotte, Atlanta, Cincinnati, and many more with an average of 18% annual cash on cash roi & 8.0% cap rate or higher.

- Rockstar Investments also assisted in raising 10mm to acquire &/or build and structure 5 syndications which accounted for 359 units in a mix of apartment, townhome & commercial strip spaces during 2015 – 2016.

OUR FOCUS

- All developments & builds we focus on, fall in the affordable home segment.

- Finished properties range from 150k - 350k on average

- All developments & builds we focus on, fall in the affordable home segment.

- Finished properties range from 150k - 350k on average

- Have been building and selling sfr & multi family properties since 2011.

- We have pivoted into a land development group based on our niche and connections with top national & regional builders. (Nvr/Ryan Homes, Meritage, Mattamy, D.r. Horton, David Weekly Homes, Essex Homes, Eastwood Homes, etc.

JUST SOME OF THE AREAS WE INVEST, DEVELOP & BUILD

Greater Charlotte, NC

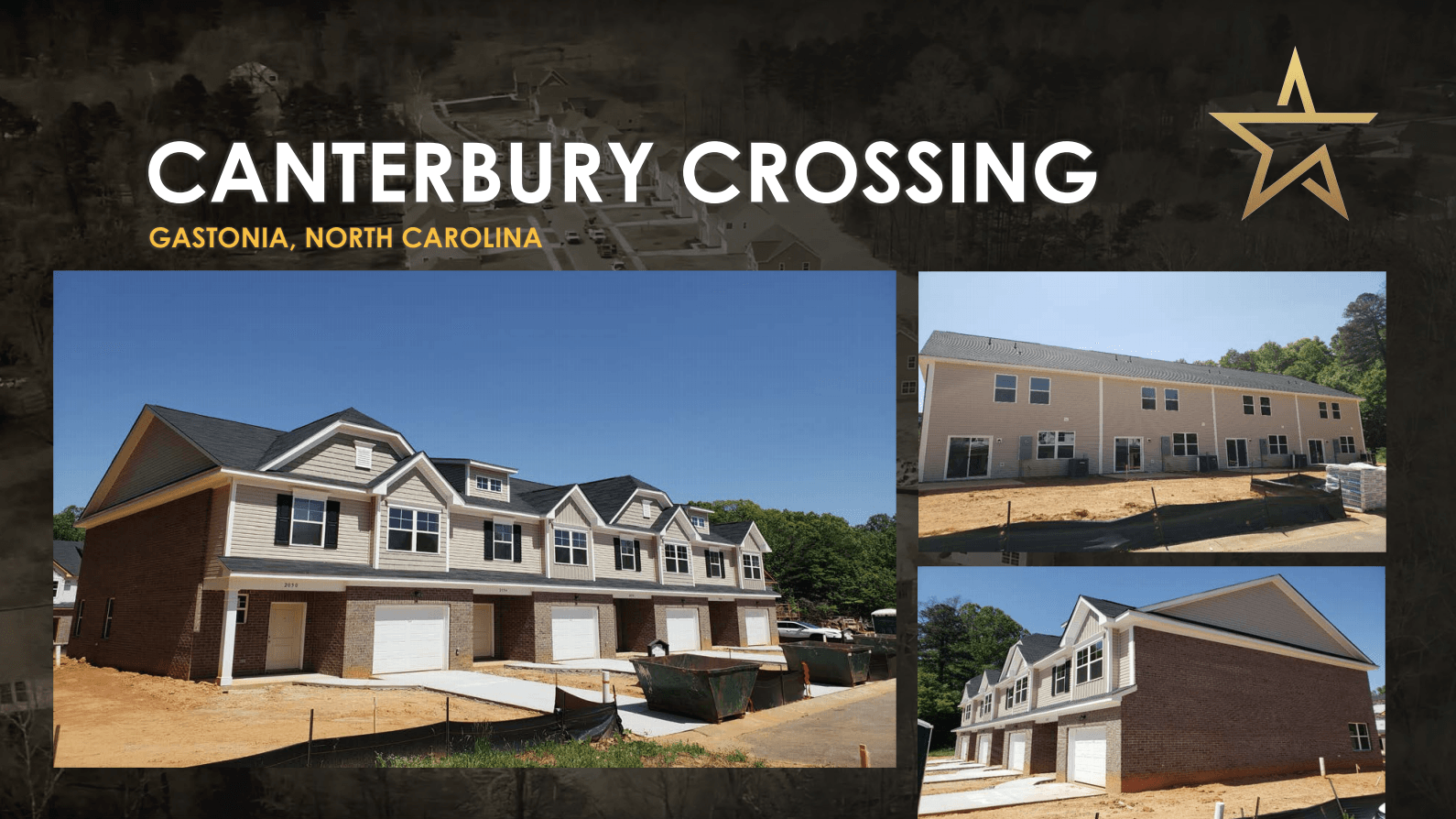

Canterbury Crossing

(36 townhomes - SOLD)

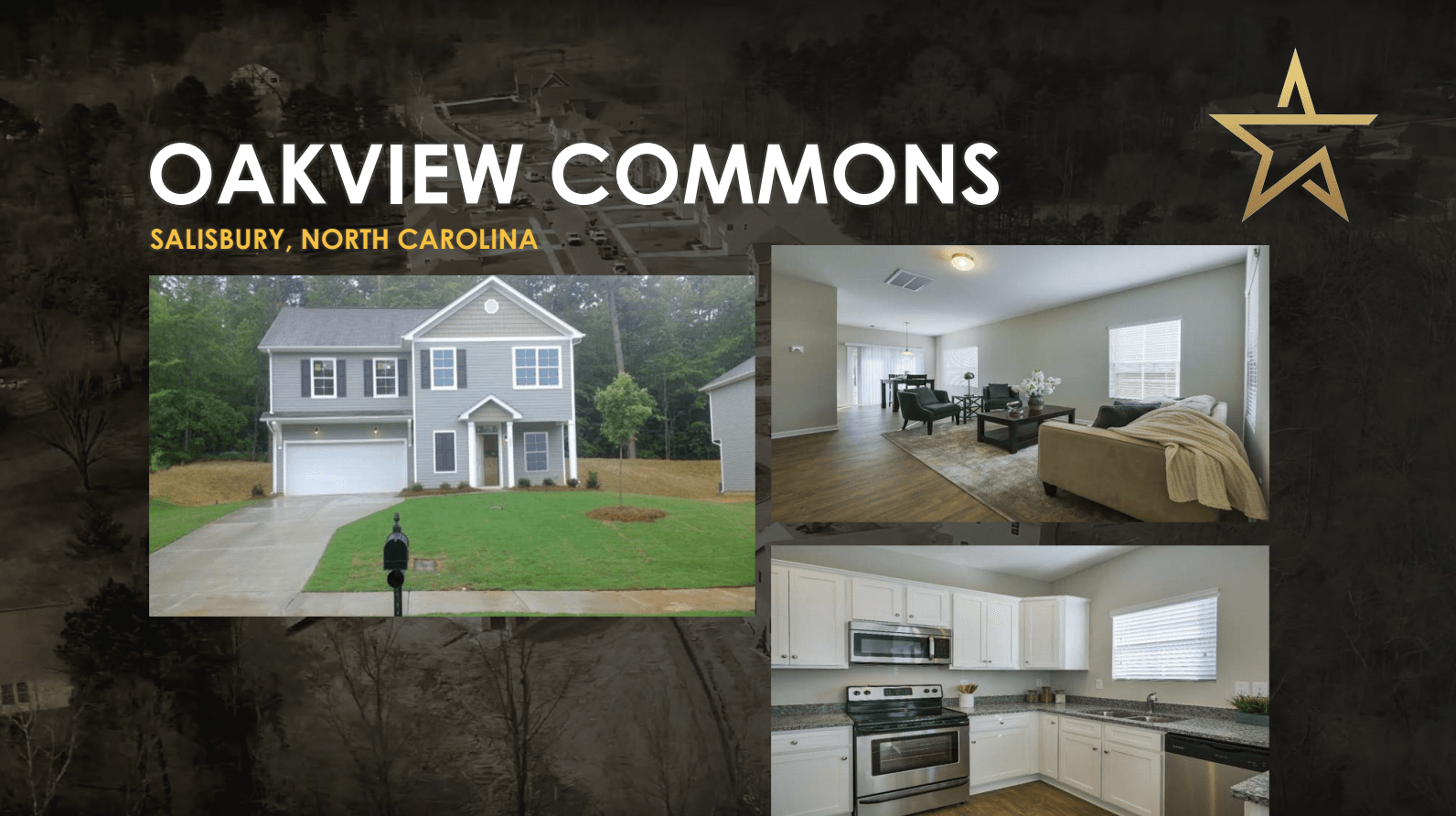

Oakview Commons

(30 Single Family Homes - SOLD)

Pleasant Grove 115 Lot Development

Shovel Ready Development - SOLD